Image Credit: Christopher Furlong/Getty Images

Image Credit: Christopher Furlong/Getty Images For years, the climate change lobby was laser-focused on just one aspect of the “climate change” crusade: the end – which supposedly is some world where the temperatures no longer rise due to fossil fuel emissions (because we now live in a world of global warming as scientists agree, not to be confused with the global cooling hypothesis that emerged in the 1970s, when many were even warning of a new ice age) justifying the means.

Meanwhile the “means”, or the final cost to taxpayers of all that endless, tedious virtual signaling, was almost never touched upon for a reason – as we first explained three weeks ago, the bill for getting the world from point A to that mythical, utopic point B, was so high, it would be double global GDP.

For those who missed it, here is an excerpt of what we wrote back on October 14, shortly after Bank of America published the definitive compendium on climate change and the coming Net Zero (i.e., great reset) world, and which we discussed in depth:

“while it is handy to have a centralized compendium of the data, a 5 minute google search can provide all the answers that are “accepted” dogma by the green lobby. But while we don’t care about the charts, that cheat sheets, or the propaganda, what we were interested in was the bottom line – how much would this green utopia cost, because if the “net zero”, “ESG”, “green” narrative is pushed so hard 24/7, you know it will cost a lot.

Turns out it does. A lot, lot.

Responding rhetorically to the key question, “how much will it cost?”, BofA cuts to the chase and writes $150 trillion over 30 years – some $5 trillion in annual investments – amounting to twice current global GDP!

Cutting to the chase, we said that “if it sounds like “the crusade against climate change” is one giant con game meant to enrich a handful of kleptocrats here and now, while the nebulous benefits – and the all too certain debt and hyperinflation – of this revolutionary overhaul of the global economy are inherited by future generations, it’s because that’s precisely what it is.” This was BofA’s startling admission of the above, as excerpted from the report’s Q&A on the Climate Change Conference (COP 26):

Q: What is the economic impact of net zero?

A: The inflation impact of elevated net zero funding will not be insignificant but the impact looks manageable at 1% to 3% per annum depending on central bank monetization rates, particularly if government spending is targeted and contributes to accelerate the rate of global GDP growth. The IEA also has a productive outlook for their net zero scenario, where the change in the annual growth rate of GDP accelerates by somewhere between 0.3% and 0.5% on a sustained basis over the next 10 years as a result of a shift to a green economy.

So, much more QE for the next 30 years, check. What about inflation? Oh, there will be plenty of that too. As BofA admits, “green bond purchases could result in a 1% to 3% inflation p.a. shock“

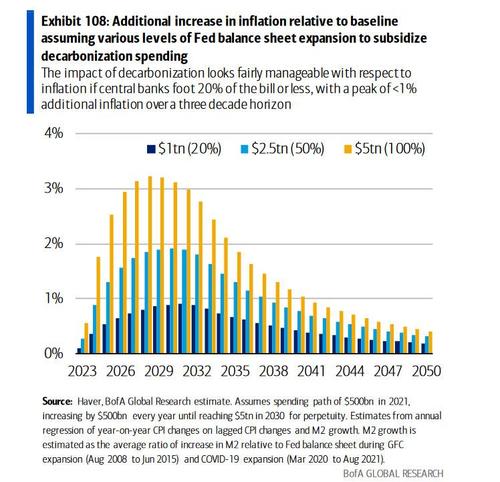

BofA looked at three separate cases. In the first case, the Fed, ECB and other central banks would subsidize all of the required infrastructure spending to decarbonize (translation: print the money). In a second scenario, they would absorb only half of the new bond issuance. And in a third case, central banks take up only a fifth of all decarbonization spending onto their balance sheet. What is the key finding? If central banks only have to foot 20% of the bill or less, the impact of decarbonization looks “fairly manageable” with respect to inflation (Exhibit 108).

And just so readers know what to BofA looks “manageable” here it is: this is inflation on top of whatever inflation is already in the economy. Of course, if central banks have to “foot” 50%, 80%, or more, well… it gets much worse.

To be sure, while having a realistic estimate of just how much this unprecedented global “grand reset” will cost is imperative, establishment politicians can simply say that the numbers are ridiculous, and the cost will never be as high as the staggering BofA estimate of between $100 and $150 trillion.

Unless, of course, one of the most important politicians and officials of the current globalist regime confirms it. Which is precisely what happened this week during the Keynote Remarks from US Treasury Secretary Janet Yellen, who was speaking at the COP26 “net zero” climate change conference in Glasgow (or Edinburgh if you are CNN). Here are the key excerpts:

Keynote Remarks by Secretary of the Treasury Janet L. Yellen at COP26 in Glasgow, Scotland at the Finance Day Opening Event

Glasgow and COP26 is a pivotal moment at the start of this decisive decade of climate action. The climate crisis is already here. This is not a challenge for future generations, but one we must confront today.

Rising to this challenge will require the wholesale transformation of our carbon-intensive economies. It’s a global transition for which we have an estimated price tag: some have put the global figure between $100 and $150 trillion over the next three decades. At the same time, addressing climate change is the greatest economic opportunity of our time.

For now, we are nowhere near: in fact, as Yellen admitted what has been pledged so far is a drop in the provberbial bucket.

Many of the conversations here in Glasgow will rightfully focus on the way we use our public resources to fund climate mitigation and adaptation activities domestically and – for those in a position to do so – to assist other countries in responding to climate change. I agree we all must do more, and the United States is stepping up. President Biden has already announced that we are quadrupling our international climate finance for developing countries by 2024 to more than $11 billion.

It is what is coming next that is terrifying:

And later this afternoon I will be speaking specifically on what we are doing to mobilize climate finance to emerging and developing economies, including our engagement with the multilateral development banks and institutions. I hope you will join me to hear more.

These programs are exciting. But as big as the public sector effort is across all our countries, the $100-trillion plus price tag to address climate change globally is far bigger.

These numbers are simply staggering, and as Yellen concedes, “The gap between what governments have and what the world needs is large, and the private sector needs to play a bigger role.”

Of course, it is easy to make some arbitrary, non-binding pledge meant purely for optical purposes to reach the funding threshold. It is far more difficult to actually obtain the funds. Case in point: an alliance championed by former central banker and current eco-fanatic, Mark Carney as well as private jet-setting “eco friendly” billionaire Mike Bloomberg, and representing 40% of the world’s financial assets has now pledged to meet the goals set out in the Paris climate agreement

More than 450 firms representing $130 trillion of assets now belong to the Glasgow Financial Alliance for Net Zero (GFANZ), almost double the roughly $70 trillion when GFANZ was launched in April, according to a progress report published by the coalition on Wednesday. Signatories must commit to use science-based guidelines to reach net zero carbon emissions by mid-century, and to provide 2030 interim goals. Investment managers accounted for $57tn of the assets, with $63tn coming from banks and $10tn from asset owners such as pension funds. Among the finance groups signed up to Gfanz are HSBC, Bank of America and Santander.

“We now have the essential plumbing in place to move climate change from the fringes to the forefront of finance so that every financial decision takes climate change into account,” said Carney, the former governor of the Bank of England who has been chair of Gfanz since its launch in April.

Alas, as with most things having to do with climate change, this is just another giant, virtue signaling circle-jerk. As even Bloomberg’s own propaganda outlet, Bloomberg Green, admits despite the huge headline number, “skeptics question the underlying terms of the commitments.” According to French nonprofit Reclaim Finance, none of the sub-alliances that make up GFANZ require signatories to stop financing fossil-fuel expansion. And since the 2015 Paris accord was struck, global banks have funneled $4 trillion into oil, gas and coal, with almost half a trillion of that allocated this year alone, according to Bloomberg data.

In short, this is one big joke, and one doesn’t even need to read the FT’s “explainer” asking “Do the maths on Mark Carney’s $130tn net zero pledge stack up?” Instead, we refer readers to what we wrote previously, that – as even BofA admits, the funding need for the global “net zero” grand reset is all about greenlighting the biggest QE episode in history, one which will spark an inflationary inferno, debase the dollar, unleash digital central bank currencies, saddle the world with hundreds of trillions more in unrepayable debt, all the while making the rich far richer than they are now.

We just see a peak of <1% additional inflation a year over a three decade horizon. Under more aggressive scenarios where central banks opt to absorb either half or the full decarbonization bills through quantitative easing, the risks of an inflation shock grow. Still, we think our third case is the most likely scenario, as it would be politically difficult to justify a much more expansive monetary impulse. True, while central bankers have expressed a desire to help green the economy, their corporate bond purchases have historically been restricted to crisis time policies through quantitative easing and remain well below purchases of sovereign debt. As such, any purchases of corporate green bonds would likely be limited both by the size of future purchase programs and their proportion relative to the overall corporate bond market, with slightly higher allocations under more progressive purchase policies that highlight environmental concerns

And there you have it: just as covid was one giant smokescreen to “allow” central banks and Treasuries to merge and lead us to Helicopter Money and MMT, creating some $30 trillion in liquidity in the process, the “Net Zero” myth is what will perpetuate this endless printing for the next 30 years, a period during which the only benefits will be bestowed upon those who benefit from QE and money printing. That would be the richest. As for everyone else, well you great grandchildren or their grandchildren may (or may not) live in a cleaner world. We really don’t know, but if we don’t start printing money now it will be too late.

If that sounds scarier, more manipulative and far more destructive than any cargo cult in human history, it’s because it is. As for global warming, 30 years from now absolutely nothing about the world’s present course will have changed (after all the bulk of the money will simply be embezzled as always happens when funds enter the public sector, never to be heard from again), but at least central banks will be around to backstop all assets for the next 30 years… You know, for the climate.

As before, the full 114 page report from Bank of America on the true costs of climate change and which we recommend to anyone who wants to know what is truly behind the push for “net zero”, is available to pro subs.